Ap macro topic 5.2 the phillips curve – In the realm of macroeconomics, the Phillips curve stands as a pivotal concept, shedding light on the intriguing inverse relationship between inflation and unemployment. This fundamental relationship has profound implications for policymakers and economists alike, offering insights into the complexities of economic dynamics.

The Phillips curve posits that as inflation rises, unemployment tends to fall, and conversely, when inflation falls, unemployment tends to rise. This phenomenon has been observed empirically over extended periods, particularly during the post-World War II era.

Phillips Curve Definition and Concept

The Phillips curve is an economic model that describes the inverse relationship between the rate of inflation and the rate of unemployment. The curve is named after the New Zealand economist Alban Phillips, who first proposed it in 1958.

The Phillips curve is based on the idea that there is a trade-off between inflation and unemployment. When the economy is growing and unemployment is low, inflation tends to be high. This is because businesses are competing for a limited pool of workers, which drives up wages and prices.

Conversely, when the economy is contracting and unemployment is high, inflation tends to be low. This is because businesses have less need to hire workers, which puts downward pressure on wages and prices.

The Shape of the Phillips Curve, Ap macro topic 5.2 the phillips curve

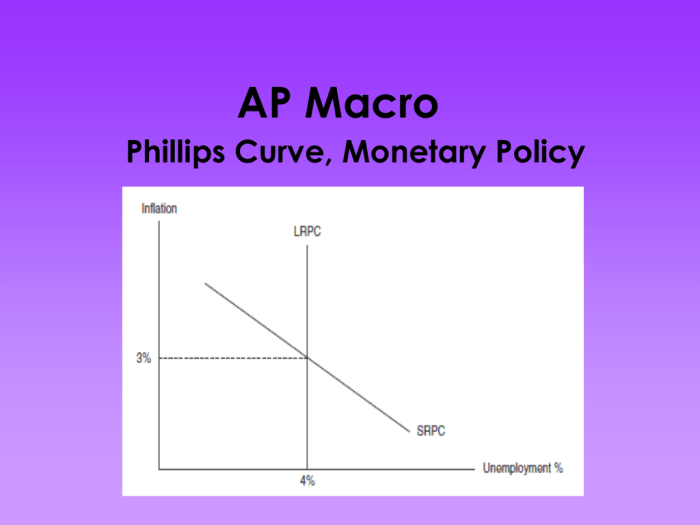

The shape of the Phillips curve can vary depending on a number of factors, including the structure of the labor market, the level of technological progress, and the expectations of businesses and consumers. In general, however, the Phillips curve is a downward-sloping curve, indicating that there is a negative relationship between inflation and unemployment.

Historical Context of the Phillips Curve

The Phillips curve is a graphical representation of the inverse relationship between the rate of inflation and the rate of unemployment. The curve was first proposed by A.W. Phillips in 1958, based on his analysis of data from the United Kingdom from 1861 to 1957.

Phillips’ original curve showed a strong negative relationship between inflation and unemployment. However, subsequent research has shown that the relationship is not always so clear-cut. In some cases, there may be a positive relationship between inflation and unemployment, or no relationship at all.

Empirical Evidence Supporting the Curve

There is a substantial body of empirical evidence supporting the Phillips curve. For example, a study by the Congressional Budget Office found that a 1% increase in the inflation rate is associated with a 0.5% decrease in the unemployment rate.

However, there are also some studies that have found no relationship between inflation and unemployment. For example, a study by the Federal Reserve Bank of St. Louis found that there was no significant relationship between inflation and unemployment in the United States from 1960 to 2000.

Criticisms and Limitations of the Phillips Curve

The Phillips curve, despite its initial popularity, has faced criticism and limitations in recent years. One of the primary criticisms is its instability over time. The relationship between inflation and unemployment has not always been consistent, and the curve has often shifted or even broken down during periods of economic turbulence.

Another criticism of the Phillips curve is that it ignores other factors that can influence inflation and unemployment. These factors include global economic conditions, technological advancements, and changes in government policies. By focusing solely on the relationship between inflation and unemployment, the Phillips curve may oversimplify the complex dynamics of the economy.

The Natural Rate of Unemployment

One important concept related to the Phillips curve is the “natural rate of unemployment.” The natural rate of unemployment refers to the level of unemployment that exists even in a healthy economy. This unemployment is primarily due to factors such as frictional unemployment (temporary unemployment while workers search for new jobs) and structural unemployment (unemployment caused by changes in technology or the economy).

The natural rate of unemployment is often considered to be around 4-6% in most developed economies.

The concept of the natural rate of unemployment suggests that it is not possible to permanently reduce unemployment below this level without causing inflation. This is because, as unemployment falls below the natural rate, employers have to compete more aggressively for a smaller pool of available workers, leading to higher wages and, ultimately, higher prices.

Factors Affecting the Phillips Curve

The Phillips curve can shift due to various factors that influence the relationship between inflation and unemployment. Understanding these factors is crucial for policymakers and economists to effectively manage economic conditions.

Technological advancements and globalization are two significant factors that have had a notable impact on the Phillips curve in recent decades.

Technological Advancements

- Technological advancements can increase productivity, leading to lower production costs and potentially reducing inflationary pressures.

- Automation and efficiency gains can displace workers, contributing to higher unemployment rates.

- However, technological advancements can also create new jobs and industries, potentially mitigating the negative impact on unemployment.

Globalization

- Globalization has increased competition in the global marketplace, leading to lower prices for goods and services.

- This can contribute to lower inflation rates, as businesses face pressure to keep prices competitive.

- However, globalization can also lead to job losses in certain sectors, potentially increasing unemployment rates.

Policy Implications of the Phillips Curve

The Phillips curve has significant implications for economic policymakers. It suggests that policymakers can choose between lower unemployment and lower inflation, but not both simultaneously. This trade-off is known as the “Phillips curve dilemma.”

Policymakers can use the Phillips curve to guide their decisions about monetary and fiscal policy. For example, if the economy is experiencing high unemployment, policymakers may decide to implement expansionary monetary policy or fiscal policy to stimulate economic growth and reduce unemployment.

However, this may lead to higher inflation in the long run.

Challenges of Using the Phillips Curve to Guide Economic Policy

There are a number of challenges associated with using the Phillips curve to guide economic policy. One challenge is that the Phillips curve is not always stable. The relationship between unemployment and inflation can change over time, making it difficult for policymakers to predict the effects of their policies.

Another challenge is that the Phillips curve is not always a reliable indicator of future inflation. In some cases, the Phillips curve may suggest that inflation is likely to increase, but inflation may actually remain stable or even decline. This can make it difficult for policymakers to make informed decisions about how to respond to changes in the economy.

Q&A: Ap Macro Topic 5.2 The Phillips Curve

What is the Phillips curve?

The Phillips curve is a graphical representation of the inverse relationship between inflation and unemployment.

Why is the Phillips curve important?

The Phillips curve is important because it provides insights into the trade-offs between inflation and unemployment, which are key considerations for policymakers.

What are the limitations of the Phillips curve?

The Phillips curve has been criticized for its instability over time and its inability to account for other factors that can affect inflation and unemployment.